Economic Impacts of Alternative Growth Scenarios in the Charlotte Metropolitan Region in 2030

Environmental Decision Toolkit

- EDT Projects

- National

- Regional

- Place Based

Introduction

ReVA and SEQL partners were interested in assessing the potential fiscal impacts of expected new population and job growth for the 15 counties within the SEQL study region.

Of particular concern was the effect that growth would have on regional air quality since the area needed to develop a strategy to regain compliance with Clear Air Act regulations.

Since mobile sources, such as cars and trucks, appear to be the primary culprit in air quality concerns, new land use plans were formulated to address air quality and other quality of life concerns. Land use planning was driven, in part, by a desire to reduce the number of miles driven and to reduce traffic congestion.

Therefore, planners sought to understand how alternative land-use scenarios might be used to alleviate air quality concerns and what the costs of alternative land use plans might be. To make this assessment, ReVA investigators considered the Charlotte metropolitan area under two possible future scenarios.

The scenarios were developed to assist community leaders in developing land use policies that would promote high quality of life and facilitate economic growth as the region continued to develop.

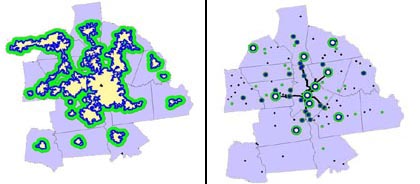

Two land use change scenarios were evaluated, representing projected housing and employment conditions in 2030 (see figure below):

- current trends towards moderate levels of housing density (Medium Density scenario) or

- a shift to compact growth and designated town centers (Compact Centers scenario).

Representation of Compact Centers (right) and Medium Density (left) growth scenarios for the SEQL study area.

Representation of Compact Centers (right) and Medium Density (left) growth scenarios for the SEQL study area.

How to Measure Fiscal Impact

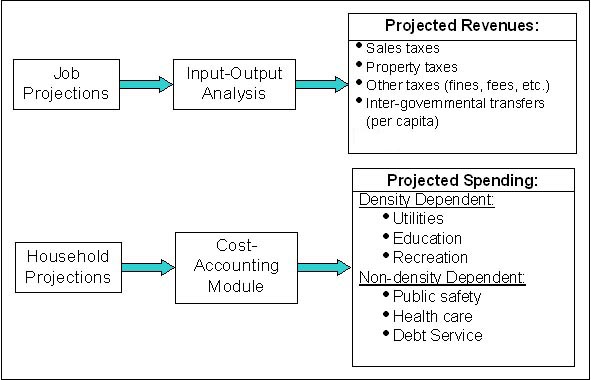

Estimates of future fiscal impacts for the two land-use change scenarios used local economic projections and financial information to inform county-level economic models within the SEQL region.

A range of data sources were used to produce estimates of revenues and expenditures for each county. Economic analyses from a previous study were used to generate projections of job growth by economic sector and future housing value. Local and national figures on infrastructure costs and property values were used to inform the analysis. New models and analyses were developed to project changes between alternative land use scenarios:

1. Public revenues from taxes and other sources, and

2. Public and some private costs for services and infrastructure as a function of land use density (see figure to the left).

Because of the level of detail used to estimate spending within counties, the results are best interpreted in terms of relative fiscal differences between land use scenarios, rather than representing exact fiscal impacts.

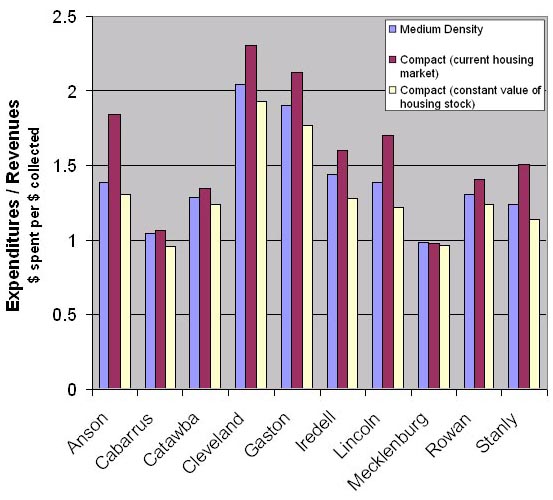

Results of FIA showing Compact Centers vs. Medium Density. Higher numbers show worse economic outcomes. The Y-axis represents the amount spent for every dollar collected and numbers above 1 are net deficits for the county.

Results of FIA showing Compact Centers vs. Medium Density. Higher numbers show worse economic outcomes. The Y-axis represents the amount spent for every dollar collected and numbers above 1 are net deficits for the county. Results

Results of the FIA showed expected average annual change in revenues, expenditures and net changes in the year 2030 by county due to new growth in housing, people, and jobs.

Urban Counties

Public revenues were consistently greater than expenditures in the Compact Centers compared to the Medium Density scenario for the most urban county (Mecklenberg), regardless of assumptions used.

Suburban / Rural Counties

Fiscal results in outlying counties were sensitive to assumptions about the housing market

When total value of housing stock was held constant, all but one county (Chester) was fiscally better off under the Compact Centers scenario.

If housing stock reflects current relative market values for high density and low-density housing, then all but one county (Lancaster) was fiscally worse off under the Compact Centers scenario.

Overall Results

Compact Centers growth appeared to be a clear fiscal winner for urban areas

Compact Centers growth advantages were unclear for small towns and rural areas

The effects of the growth scenario conditions on personal property taxes have not yet been evaluated, so the net effect on all tax revenues to counties could not be definitively assessed.

![[logo] US EPA](../gif/logo_epaseal.gif)